According to information released earlier these days , its gdp grew at a seasonally adjusted .four percent in the second quarter. The figure fell from 4.4 % in comparison with the prior quarter. Its cooling recovery produced this country shed its second position in the world. China overtook Japan in monetary size as the world ‘s No. two economy.

On Friday trading, the Japanese stock exchange was covered with depression, with the benchmark Nikkei typical down practically 2 per cent to 9,179.38.

Prime Minister Naoto Kan, who assured to reduce the nation ‘s massive financial obligation, mulled feasible options from his Cabinet. Such options restrict brand-new spending, recommending tax and governing reforms.

Kyodo news firm reported his saying that they had to think about in fresh monetary spending. Boosting require or restoring recuperation without having depending on economic spending appeared possible.

Japan has actually emerged from slowdown provided that a year eariler. Exporters and manufacturers posted profits thanks to robust want in China and some parts of Asia. A sharp decline of financial growth in April – June duration did not make economists and federal government officials anxious.

In addition to cooling recovery, the yen struck a 15-year-high against the dollar final week. Its strong currency props up buyers ‘ purchasing. Nevertheless, exporters like Toyota Motor Corp. and Sony Corp dealt with falling incomes. Even though the yen remains to strengthen, the federal government is keen to intervening to steer clear of the risk of stagnancy.

In an try to secure Japan ‘s slow recuperation, the federal government possibly approves the stimulus package as early as subsequent month. The government has actually stepped up pressure on the Bank of Japan to take measures to tackle the strengthening yen.

Koichiro Genba, minister of state for civil service reform, blamed the Bank of Japan for the yen ‘s appreciation. The bank failed to take added monetary alleviating measures. He mentioned that there was distinction in United States fed ‘s and the Bank of Japan ‘s technique to their specific currencies.

Whilst the United States Federal Reserve downgraded its outlook for the US economy, announcing extra decreasing measures last week, the Japanese bank has in fact not prospered in reacting to wish for extra alleviating.

Transportation minister Seiji Maehara highlighted on the adoption of distinct financial and monetary policies in cooperation with other nations.

It was stated that the federal government ‘s news stimulus plan may possibly consist of new solutions to help young folks uncover jobs and consist of measures to prop up small and medium enterprise.

Moreover, the government is most probably to plot new green stimulus bundle for clean innovation makers, which drives more investment in clean and energy efficient innovations. According to the government ‘s draft strategy, factories which develop green technologies would receive brand-new subsidies.

Economics is the study of our lives, our tasks, our homes, our families and the small options we deal with every day. Therefore, I am eager on reading and studying monetary concerns.

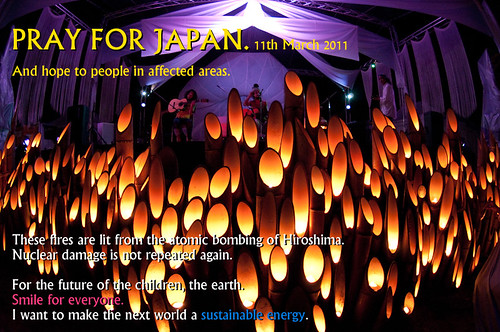

JAPAN!!!

Image by

(C) toitoi Please Donate For Japan Earthquake.

Please wish suffering property owner in stricken places.

your warm hearted words and donation cash

motivate folks of the stricken location and can comfort!

Contribute List.

Japanease.

www/nanapi. jp/24717/. irritantis.information/ archives/652 English. www1.networkforgood.org/ aid-survivors-pacific-quake-tsunami

. Japanease. docs.google.com/document/pub?id=1MvIFT9iPuI2gI1lA91xuLkw4 … English. docs.google.com/document/pub?id=10idoXV2k2NgYrOR7SSJJKue8… www.flickr.com/groups/donatejp/go over/72157626145475845 Flickr Group. www.flickr.com/groups/donatejp/ About thispicture. These fires are lit

from the atomic bombing of Hiroshima. Nuclear harm is not repeated once more.

For the future of the youngsters, the earth. Smile for everybody.

I wish to make a sustainable world together. toitoi.

Japan mulls stimulus to aid recovery

No comments:

Post a Comment